Does he want a cookie for that? Or should I give it to you?

Charts that summarize what's wrong with America

- Thread starter IPride

- Start date

It means that what he did was far better than what the top 500 companies, according to SP, did in the stock market.

So your quip about Apple is stupid, frankly.

If you want to read how good people betting against the US and on Gold have performed over the past 2-3 years, google John Paulson.

But frankly, all of this is getting pretty stupid and irrelevant now. If someone doesn't know anything about financial markets, it's pretty senseless.

Last edited:

Again with Kaz and his inaccurate beliefs and statements.

1- Hedging against inflation does not mean that the monetary system in place is about the collapse. If Ron Paul or anyone else believed that the US monetary system was about the collapse they would not hold ANY stocks as once the US dollar collapses so does the economy and all the companies that trade on the stock market. If you truly believe the US monetary system is unsustainable you should stock up on commodities (fuel, metals, grains, etc.) in preparation for a barter system.

What most money managers hope to protect themselves against is fluctuations above or below the expected inflation rate, which could be caused by a number of factors (including spikes in energy prices for example). Some level of inflation has and always will be part of the US monetary system, as Fed attempts to expand the monetary supply in line with economic growth. Most monetarists agree that contracting the money supply or not expanding it in lock-step with economic growth constraints growth. And when Friedman came out and said that the Fed caused the depression it had nothing to do with Keynes or anyone else as you erroneously alluded to before - he meant that at a time when the Feds and other central banks should have been expansionary (in the monetary sense) they were contracting the money supply.

Fed continues to maintain a long-run inflation target of 2% (annually) - so yes by 2062 if their target holds on average the dollar will be worth 159% less, but do you think any rational mind is concerned about this? of course not, because it's expected.

2- While gold has traditionally been believed to be a hedge against inflation - events over the last few years have proved that the forces driving up gold prices is much more about people betting against inflation.

On the demand side countries like China and India are fast becoming the largest consumers of gold (in jewelry, industry, etc.) - as a matter of fact 50% of gold sold on an annual basis is sold in India and China.

On the supply side it's getting much more expensive for companies to extract gold as most of the easy extractions have already been had. Here's the interesting part, I encourage all of you to pull up the 5-yr stock charts of the biggest gold companies in the world ABX, GG, AUY, etc... they haven't really followed gold prices - as a matter of fact, they haven't done much! As a matter of fact, ABX, the biggest gold company in the world is very close to where it was 5 years ago, while gold prices have gone up in multiples. This corroborates the notion that gold prices have climbed up because while India and China are growing their demands for gold, its getting costlier for world producers to keep up with this demand.

So again so much for Ron Paul's understanding of the world around him.

3- And if gold price is such a good gauge for future inflation and overall health of the monetary system, why hasn't it gone anywhere over the past year when the Fed announced multiple extensions to quantitative easing? I'm not even sure it did much last week when the Fed announced it was pumping $85B of money on a monthly basis indefinitely.

1- Hedging against inflation does not mean that the monetary system in place is about the collapse. If Ron Paul or anyone else believed that the US monetary system was about the collapse they would not hold ANY stocks as once the US dollar collapses so does the economy and all the companies that trade on the stock market. If you truly believe the US monetary system is unsustainable you should stock up on commodities (fuel, metals, grains, etc.) in preparation for a barter system.

What most money managers hope to protect themselves against is fluctuations above or below the expected inflation rate, which could be caused by a number of factors (including spikes in energy prices for example). Some level of inflation has and always will be part of the US monetary system, as Fed attempts to expand the monetary supply in line with economic growth. Most monetarists agree that contracting the money supply or not expanding it in lock-step with economic growth constraints growth. And when Friedman came out and said that the Fed caused the depression it had nothing to do with Keynes or anyone else as you erroneously alluded to before - he meant that at a time when the Feds and other central banks should have been expansionary (in the monetary sense) they were contracting the money supply.

Fed continues to maintain a long-run inflation target of 2% (annually) - so yes by 2062 if their target holds on average the dollar will be worth 159% less, but do you think any rational mind is concerned about this? of course not, because it's expected.

2- While gold has traditionally been believed to be a hedge against inflation - events over the last few years have proved that the forces driving up gold prices is much more about people betting against inflation.

On the demand side countries like China and India are fast becoming the largest consumers of gold (in jewelry, industry, etc.) - as a matter of fact 50% of gold sold on an annual basis is sold in India and China.

On the supply side it's getting much more expensive for companies to extract gold as most of the easy extractions have already been had. Here's the interesting part, I encourage all of you to pull up the 5-yr stock charts of the biggest gold companies in the world ABX, GG, AUY, etc... they haven't really followed gold prices - as a matter of fact, they haven't done much! As a matter of fact, ABX, the biggest gold company in the world is very close to where it was 5 years ago, while gold prices have gone up in multiples. This corroborates the notion that gold prices have climbed up because while India and China are growing their demands for gold, its getting costlier for world producers to keep up with this demand.

So again so much for Ron Paul's understanding of the world around him.

3- And if gold price is such a good gauge for future inflation and overall health of the monetary system, why hasn't it gone anywhere over the past year when the Fed announced multiple extensions to quantitative easing? I'm not even sure it did much last week when the Fed announced it was pumping $85B of money on a monthly basis indefinitely.

2- While gold has traditionally been believed to be a hedge against inflation - events over the last few years have proved that the forces driving up gold prices is much more about people betting against inflation.

On the demand side countries like China and India are fast becoming the largest consumers of gold (in jewelry, industry, etc.) - as a matter of fact 50% of gold sold on an annual basis is sold in India and China.

On the supply side it's getting much more expensive for companies to extract gold as most of the easy extractions have already been had. Here's the interesting part, I encourage all of you to pull up the 5-yr stock charts of the biggest gold companies in the world ABX, GG, AUY, etc... they haven't really followed gold prices - as a matter of fact, they haven't done much! As a matter of fact, ABX, the biggest gold company in the world is very close to where it was 5 years ago, while gold prices have gone up in multiples. This corroborates the notion that gold prices have climbed up because while India and China are growing their demands for gold, its getting costlier for world producers to keep up with this demand.

On the demand side countries like China and India are fast becoming the largest consumers of gold (in jewelry, industry, etc.) - as a matter of fact 50% of gold sold on an annual basis is sold in India and China.

On the supply side it's getting much more expensive for companies to extract gold as most of the easy extractions have already been had. Here's the interesting part, I encourage all of you to pull up the 5-yr stock charts of the biggest gold companies in the world ABX, GG, AUY, etc... they haven't really followed gold prices - as a matter of fact, they haven't done much! As a matter of fact, ABX, the biggest gold company in the world is very close to where it was 5 years ago, while gold prices have gone up in multiples. This corroborates the notion that gold prices have climbed up because while India and China are growing their demands for gold, its getting costlier for world producers to keep up with this demand.

I BEG YOUR PARDON?

What's stupid about it? It's a chart showing the performance of Apple. The rise of gold has slowed down for now and while some goldnuts were suggesting gold prices of 2000, it didn't even get close and over the past 2 years, US T-Notes were a better investment.

If you want to read how good people betting against the US and on Gold have performed over the past 2-3 years, google John Paulson.

But frankly, all of this is getting pretty stupid and irrelevant now. If someone doesn't know anything about financial markets, it's pretty senseless.

What's stupid about it? It's a chart showing the performance of Apple. The rise of gold has slowed down for now and while some goldnuts were suggesting gold prices of 2000, it didn't even get close and over the past 2 years, US T-Notes were a better investment.

If you want to read how good people betting against the US and on Gold have performed over the past 2-3 years, google John Paulson.

But frankly, all of this is getting pretty stupid and irrelevant now. If someone doesn't know anything about financial markets, it's pretty senseless.

Did you read the %+- for SP500 vs Paul's stocks? Try again.

Thanks so much for YouTube..

[video=youtube;WEoGKpnutyA]http://www.youtube.com/watch?v=WEoGKpnutyA[/video]

[video=youtube;WEoGKpnutyA]http://www.youtube.com/watch?v=WEoGKpnutyA[/video]

spot on...the reason people invest in gold is more or less the same why they invest in treasuries. If the US was about to collapse, then you wouldn't give them all the money with 2% interest. They have been predicting hyperinflation eversince QE started. So far the likes of Krugman were right on the money and everyone else wrong.

That the US Dollar is the reserve currency means that immediate inflation is not going to be communicated, but it is going to happen eventually. Consistent/perpetual dilution in currency, or inflation of the money supply, will lead to hyperinflation. It's not a matter of 'if' but 'when'. That 'when' hasn't happened yet doesn't prove Krugman right.

Last edited:

Again with Kaz and his inaccurate beliefs and statements.

1- Hedging against inflation does not mean that the monetary system in place is about the collapse. If Ron Paul or anyone else believed that the US monetary system was about the collapse they would not hold ANY stocks as once the US dollar collapses so does the economy and all the companies that trade on the stock market. If you truly believe the US monetary system is unsustainable you should stock up on commodities (fuel, metals, grains, etc.) in preparation for a barter system.

1- Hedging against inflation does not mean that the monetary system in place is about the collapse. If Ron Paul or anyone else believed that the US monetary system was about the collapse they would not hold ANY stocks as once the US dollar collapses so does the economy and all the companies that trade on the stock market. If you truly believe the US monetary system is unsustainable you should stock up on commodities (fuel, metals, grains, etc.) in preparation for a barter system.

What most money managers hope to protect themselves against is fluctuations above or below the expected inflation rate, which could be caused by a number of factors (including spikes in energy prices for example). Some level of inflation has and always will be part of the US monetary system, as Fed attempts to expand the monetary supply in line with economic growth. Most monetarists agree that contracting the money supply or not expanding it in lock-step with economic growth constraints growth. And when Friedman came out and said that the Fed caused the depression it had nothing to do with Keynes or anyone else as you erroneously alluded to before - he meant that at a time when the Feds and other central banks should have been expansionary (in the monetary sense) they were contracting the money supply.

Friedman for most of his career thought that it was possible for someone to manage the Fed properly, but by the end of his career called for the abolishment of the Fed. Regardless of his stance on currency, even he recognised that the Fed was a poor manager.

Fed continues to maintain a long-run inflation target of 2% (annually) - so yes by 2062 if their target holds on average the dollar will be worth 159% less, but do you think any rational mind is concerned about this? of course not, because it's expected.

2- While gold has traditionally been believed to be a hedge against inflation - events over the last few years have proved that the forces driving up gold prices is much more about people betting against inflation.

On the demand side countries like China and India are fast becoming the largest consumers of gold (in jewelry, industry, etc.) - as a matter of fact 50% of gold sold on an annual basis is sold in India and China.

On the supply side it's getting much more expensive for companies to extract gold as most of the easy extractions have already been had. Here's the interesting part, I encourage all of you to pull up the 5-yr stock charts of the biggest gold companies in the world ABX, GG, AUY, etc... they haven't really followed gold prices - as a matter of fact, they haven't done much! As a matter of fact, ABX, the biggest gold company in the world is very close to where it was 5 years ago, while gold prices have gone up in multiples. This corroborates the notion that gold prices have climbed up because while India and China are growing their demands for gold, its getting costlier for world producers to keep up with this demand.

On the demand side countries like China and India are fast becoming the largest consumers of gold (in jewelry, industry, etc.) - as a matter of fact 50% of gold sold on an annual basis is sold in India and China.

On the supply side it's getting much more expensive for companies to extract gold as most of the easy extractions have already been had. Here's the interesting part, I encourage all of you to pull up the 5-yr stock charts of the biggest gold companies in the world ABX, GG, AUY, etc... they haven't really followed gold prices - as a matter of fact, they haven't done much! As a matter of fact, ABX, the biggest gold company in the world is very close to where it was 5 years ago, while gold prices have gone up in multiples. This corroborates the notion that gold prices have climbed up because while India and China are growing their demands for gold, its getting costlier for world producers to keep up with this demand.

Regardless, since 1833 gold has gone up, and up and up, every decade bar 1980s and 1990s. I'm not a Gold trader to know exactly why but that is an undeniable trend, nonetheless. Paul and his fans have made merry on this fact, as you suggested they should, so there is no argument on that end.

Gold prices throughout history - save for a part in the late 18th century - have been incredibly solid in retaining value. That was the point brought up and that fact still remains. That was the larger discussion that was being had: that people's wealth can be arbitrarily taken from them; whereas with a commodity-backed currency this cannot happen.

3- And if gold price is such a good gauge for future inflation and overall health of the monetary system, why hasn't it gone anywhere over the past year when the Fed announced multiple extensions to quantitative easing? I'm not even sure it did much last week when the Fed announced it was pumping $85B of money on a monthly basis indefinitely.

Attachments

-

18.5 KB Views: 18

Last edited:

Found an interesting article re fiat currencies:

[FONT=Times New Roman, Times, serif]In spite of constant headlines about debts and deficits, most Americans don’t really believe the U.S. dollar will collapse. From knowledgeable investors who study the markets to those seemingly too busy to worry about such things, most dismiss the idea of the dollar actually going to zero.

[/FONT]

[FONT=Times New Roman, Times, serif]History has a message for us: No fiat currency has lasted forever. Eventually, they all fail.

[/FONT]

[FONT=Times New Roman, Times, serif]BMG BullionBars recently published a poster featuring pictures of numerous currencies that have gone bust. Some got there quickly, while others took a century or more. Regardless of how long it took, though, the seductive temptations allowed under a fiat monetary system eventually caught up with these governments, and their currencies went poof!

[/FONT]

[FONT=Times New Roman, Times, serif]You might suspect this happened only to third world countries. You’d be wrong. There was no discrimination as to the size or perceived stability of a nation’s economy; if the leaders abused their currency, the country paid the price.

[/FONT]

As you scroll through the currencies below, you’ll see some long-ago casualties. What’s shocking, though, is how many have occurred in our lifetime. You might count how many currencies have failed since you’ve been born.

[FONT=Times New Roman, Times, serif]

So what’s the one word for the “thousand pictures” below? Worthless.[/FONT]

[TABLE="width: 135, align: right"]

[TR]

[TD]

[/TR]

[/TABLE]

[FONT=Times New Roman, Times, serif]With that in mind, consider the following:[/FONT]

[FONT=Times New Roman, Times, serif]Morgan Stanley reported in 2009 that there’s “no historical precedent” for an economy that exceeds a 250% debt-to-GDP ratio without experiencing some sort of financial crisis or high inflation. Our total debt now exceeds GDP by roughly 400%.[/FONT]

[FONT=Times New Roman, Times, serif]Investment legend Marc Faber reports that once a country’s payments on debt exceed 30% of tax revenue, the currency is “done for.” On our current path, analyst Michael Murphy projects we’ll hit that figure by October.[/FONT]

[FONT=Times New Roman, Times, serif]Peter Bernholz, the leading expert on hyperinflation, states unequivocally that “hyperinflation is caused by government budget deficits.” This year’s U.S. budget deficit will end up being $1.5 trillion, an amount never before seen in history.[/FONT]

Since the Federal Reserve’s creation in 1913, the dollar has lost 95% of its purchasing power. Our government leaders clearly don’t know how – or don’t wish – to keep the currency strong.

[/FONT]

[FONT=Times New Roman, Times, serif]History has a message for us: No fiat currency has lasted forever. Eventually, they all fail.

[/FONT]

[FONT=Times New Roman, Times, serif]BMG BullionBars recently published a poster featuring pictures of numerous currencies that have gone bust. Some got there quickly, while others took a century or more. Regardless of how long it took, though, the seductive temptations allowed under a fiat monetary system eventually caught up with these governments, and their currencies went poof!

[/FONT]

[FONT=Times New Roman, Times, serif]You might suspect this happened only to third world countries. You’d be wrong. There was no discrimination as to the size or perceived stability of a nation’s economy; if the leaders abused their currency, the country paid the price.

[/FONT]

As you scroll through the currencies below, you’ll see some long-ago casualties. What’s shocking, though, is how many have occurred in our lifetime. You might count how many currencies have failed since you’ve been born.

[FONT=Times New Roman, Times, serif]

So what’s the one word for the “thousand pictures” below? Worthless.[/FONT]

[FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Yugoslavia – 10 billion dinar, 1993[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Yugoslavia – 10 billion dinar, 1993[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Zaire – 5 million zaires, 1992[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Zaire – 5 million zaires, 1992[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Venezuela – 10,000 bolívares, 2002[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Venezuela – 10,000 bolívares, 2002[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Ukraine – 10,000 karbovantsiv, 1995[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Ukraine – 10,000 karbovantsiv, 1995[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Turkey – 5 million lira, 1997[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Turkey – 5 million lira, 1997[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Russia – 10,000 rubles, 1992[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Russia – 10,000 rubles, 1992[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Romania – 50,000 lei, 2001[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Romania – 50,000 lei, 2001[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Central Bank of China – 10,000 CGU, 1947[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Central Bank of China – 10,000 CGU, 1947[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Peru – 100,000 intis, 1989[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Peru – 100,000 intis, 1989[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Nicaragua – 10 million córdobas, 1990[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Nicaragua – 10 million córdobas, 1990[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Hungary – 10 million pengo, 1945[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Hungary – 10 million pengo, 1945[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Greece – 25,000 drachmas, 1943[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Greece – 25,000 drachmas, 1943[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Germany – 1 billion mark, 1923[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Germany – 1 billion mark, 1923[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Georgia – 1 million laris, 1994[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Georgia – 1 million laris, 1994[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]France – 5 livres, 1793[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]France – 5 livres, 1793[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Chile – 10,000 pesos, 1975[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Chile – 10,000 pesos, 1975[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Brazil – 500 cruzeiros reais, 1993[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Brazil – 500 cruzeiros reais, 1993[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Bosnia – 100 million dinar, 1993[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Bosnia – 100 million dinar, 1993[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Bolivia – 5 million pesos bolivianos, 1985[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Bolivia – 5 million pesos bolivianos, 1985[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Belarus – 100,000 rubles, 1996[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Belarus – 100,000 rubles, 1996[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Argentina – 10,000 pesos argentinos, 1985[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Argentina – 10,000 pesos argentinos, 1985[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Angola – 500,000 kwanzas reajustados, 1995[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Angola – 500,000 kwanzas reajustados, 1995[/FONT][FONT=Times New Roman, Times, serif]

[/FONT][FONT=Times New Roman, Times, serif]Zimbabwe – 100 trillion dollars, 2006[/FONT]

[/FONT][FONT=Times New Roman, Times, serif]Zimbabwe – 100 trillion dollars, 2006[/FONT]

[FONT=Times New Roman, Times, serif]So, will a similar fate befall the U.S. dollar? The common denominator that led to the downfall of each currency above was the two big Ds: Debts and Deficits.[/FONT]

[TABLE="width: 135, align: right"]

[TR]

[TD]

[/TD][/TR]

[/TABLE]

[FONT=Times New Roman, Times, serif]With that in mind, consider the following:[/FONT]

[FONT=Times New Roman, Times, serif]Morgan Stanley reported in 2009 that there’s “no historical precedent” for an economy that exceeds a 250% debt-to-GDP ratio without experiencing some sort of financial crisis or high inflation. Our total debt now exceeds GDP by roughly 400%.[/FONT]

[FONT=Times New Roman, Times, serif]Investment legend Marc Faber reports that once a country’s payments on debt exceed 30% of tax revenue, the currency is “done for.” On our current path, analyst Michael Murphy projects we’ll hit that figure by October.[/FONT]

[FONT=Times New Roman, Times, serif]Peter Bernholz, the leading expert on hyperinflation, states unequivocally that “hyperinflation is caused by government budget deficits.” This year’s U.S. budget deficit will end up being $1.5 trillion, an amount never before seen in history.[/FONT]

Since the Federal Reserve’s creation in 1913, the dollar has lost 95% of its purchasing power. Our government leaders clearly don’t know how – or don’t wish – to keep the currency strong.

Friedman blamed the Fed for not printing enough; whereas Keynesians hold that the free market were at fault for the great depression - a myth that still gets told to this day. When it comes to gold, or currency, I am referring to the Austrians, not Friedman. Some Austrians, IMO rightly, acknowledge that Friedman is right regarding the money supply but hold to the claim that the Fed, in the first place, created the problem. That it didn't solve it just adds to their argument that it shouldn't exist.

Friedman for most of his career thought that it was possible for someone to manage the Fed properly, but by the end of his career called for the abolishment of the Fed. Regardless of his stance on currency, even he recognised that the Fed was a poor manager.

Friedman for most of his career thought that it was possible for someone to manage the Fed properly, but by the end of his career called for the abolishment of the Fed. Regardless of his stance on currency, even he recognised that the Fed was a poor manager.

It is common knowledge among those people have studied the matter closely that the great depression was to a large extent caused by the stock market collapse of 1929, a series of bank failures and the central banks' erroneous reaction to it all. It is also a fact that the stock market crash of 1929 and the bank failures were largely due to lack of regulations preventing fraudulent activities or a bubble from forming - free markets at their best. For example, there were ways to start a company sell stock and reclaim full ownership as if no dilution had occurred. And of course, back then, every dick, joe and harry could start a bank, without the appropriate capital reserve and conduct business with people's savings.

It depends who you're calling rational and whose opinion you ask. Someone that is trying to keep their wealth is going to be worried.

Treasury Inflation Protected Securities (TIPS), are US government bonds which compensate bond holders against any rise in inflation. Not surprising to those that actually know how economics work - the 10 yr TIPS is now returning a negative rate meaning the expected rate for inflation is very very low.

Your theory for why Gold has gone up is irrelevant in regards to the consideration of how gold can, and is by some, used to hedge against inflation. Whether you are right or not, in whole or part, I'm not sure. If you look at the last 10 years, instead of 5, ABX's stock price has more than doubled. GG has basically the same performance. AUY's performance far exceeds them and has actually multiplied by 5-6 times (!) in that 10 year period. Gold prices were going up in the multiples in the earlier part of the 00s and so too were the stocks. From GG 2010 annual report:

I went on to make the contention that if supply was not being constrained and extraction was not getting costlier - gold companies would not be suffering so much.

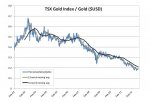

Forget GG, ABX, or any one stock - here's the performance of the gold stock index (which includes 37 of the largest gold companies in the world) to the actual price of gold over the last 10 years.

I hope we can rest this case.

Regardless, since 1833 gold has gone up, and up and up, every decade bar 1980s and 1990s. I'm not a Gold trader to know exactly why but that is an undeniable trend, nonetheless. Paul and his fans have made merry on this fact, as you suggested they should, so there is no argument on that end.

Gold prices throughout history - save for a part in the late 18th century - have been incredibly solid in retaining value. That was the point brought up and that fact still remains. That was the larger discussion that was being had: that people's wealth can be arbitrarily taken from them; whereas with a commodity-backed currency this cannot happen.

Gold prices can be a good gauge for future inflation; but what they are, are safe bets to retain wealth. Unlike fiat money.

Gold prices throughout history - save for a part in the late 18th century - have been incredibly solid in retaining value. That was the point brought up and that fact still remains. That was the larger discussion that was being had: that people's wealth can be arbitrarily taken from them; whereas with a commodity-backed currency this cannot happen.

Gold prices can be a good gauge for future inflation; but what they are, are safe bets to retain wealth. Unlike fiat money.

Found an interesting article re fiat currencies:

It's like someone showing all the software companies in the past 30 years that have failed and arguing that all software companies will eventually fail because they produce nothing tangible.

Of course when it comes to Fiat money prudent management by the central bank is paramount - all the banks that mismanage the money supply and general public's trust eventually get punished for it. Fortunately, for the US, mismanagement hasn't been a big issue yet and confidence is by large still very much existent.

Gold is a long-term hedge, which is why your 2-3 year analysis of it is not only irrelevant it is academically dishonest. As the Schiff video above you mentions.

Did you read the %+- for SP500 vs Paul's stocks? Try again.

I love that video, Krugman caught wrong on some of the more basic laws. The idiot thinks that competing currencies are legal. That was embarrassing.

No, they're not. You don't seem to get it. Both can be used as safe investments for uncertain future economic activity. But one is used over the other when the reason people are concerned is because of the government.

That the US Dollar is the reserve currency means that immediate inflation is not going to be communicated, but it is going to happen eventually. Consistent/perpetual dilution in currency, or inflation of the money supply, will lead to hyperinflation. It's not a matter of 'if' but 'when'. That 'when' hasn't happened yet doesn't prove Krugman right.

Did you read the %+- for SP500 vs Paul's stocks? Try again.

I love that video, Krugman caught wrong on some of the more basic laws. The idiot thinks that competing currencies are legal. That was embarrassing.

No, they're not. You don't seem to get it. Both can be used as safe investments for uncertain future economic activity. But one is used over the other when the reason people are concerned is because of the government.

That the US Dollar is the reserve currency means that immediate inflation is not going to be communicated, but it is going to happen eventually. Consistent/perpetual dilution in currency, or inflation of the money supply, will lead to hyperinflation. It's not a matter of 'if' but 'when'. That 'when' hasn't happened yet doesn't prove Krugman right.

Ron Paul sounded like an angry old man shouting readings from a script whereas Krugman was trying to have a debate - and the fact that nor Ron Paul nor you (and probably most other Ron Paulists) for that matter don't know about the Repo or how Repo was exactly just like a form of parallel currency does not surprise me. You people just like to read from scripts with limited knowledge of how financial worlds function these days.

Last edited:

If you're truly interested in understanding what happened during the great depression grab the book called "lords of finance" - the author won the Pulitzer prize for it.

It is common knowledge among those people have studied the matter closely that the great depression was to a large extent caused by the stock market collapse of 1929, a series of bank failures and the central banks' erroneous reaction to it all. It is also a fact that the stock market crash of 1929 and the bank failures were largely due to lack of regulations preventing fraudulent activities or a bubble from forming - free markets at their best. For example, there were ways to start a company sell stock and reclaim full ownership as if no dilution had occurred. And of course, back then, every dick, joe and harry could start a bank, without the appropriate capital reserve and conduct business with people's savings.

It is common knowledge among those people have studied the matter closely that the great depression was to a large extent caused by the stock market collapse of 1929, a series of bank failures and the central banks' erroneous reaction to it all. It is also a fact that the stock market crash of 1929 and the bank failures were largely due to lack of regulations preventing fraudulent activities or a bubble from forming - free markets at their best. For example, there were ways to start a company sell stock and reclaim full ownership as if no dilution had occurred. And of course, back then, every dick, joe and harry could start a bank, without the appropriate capital reserve and conduct business with people's savings.

Although, I should say, fraudulent activities aren't part of a free market. People breaking laws are a part of any system - there are bad people, regardless. Free market proponents don't call for anarchy, they call for courts of law and arms precisely to defend people from being cheated. I mean, this is one of the basics of a free market. You're being overzealous or don't really recognise the borders of a free market as conceived by the majority of its proponents.

Not really - if earnings go up every year by at least the amount of inflation people will have the same purchasing power, and unless they stuff their savings under their pillow instead of investing in TIPS they're going to have the value of their savings pretty much intact.

Treasury Inflation Protected Securities (TIPS), are US government bonds which compensate bond holders against any rise in inflation. Not surprising to those that actually know how economics work - the 10 yr TIPS is now returning a negative rate meaning the expected rate for inflation is very very low.

Treasury Inflation Protected Securities (TIPS), are US government bonds which compensate bond holders against any rise in inflation. Not surprising to those that actually know how economics work - the 10 yr TIPS is now returning a negative rate meaning the expected rate for inflation is very very low.

You don't buy TIPS or bonds when you're convinced the system is trying to prop itself up (i.e. the Fed buying bonds at an unprecedented rate to keep interest rates low). When that is your concern, you buy gold to hedge against the system. I am trying understand what your point is now. Whether you think they should or not is not my concern; I am explaining why they would do what they say they're doing.

I was simply poking holes in the logic of Ron Paul nuts that gold price has been going up in response to the collapse of the dollar! Whereas there are many legitimate reasons why gold prices have gone up, very few of which are related to what Bernanke is doing at the Fed.

I went on to make the contention that if supply was not being constrained and extraction was not getting costlier - gold companies would not be suffering so much.

Forget GG, ABX, or any one stock - here's the performance of the gold stock index (which includes 37 of the largest gold companies in the world) to the actual price of gold over the last 10 years.

I hope we can rest this case.

I went on to make the contention that if supply was not being constrained and extraction was not getting costlier - gold companies would not be suffering so much.

Forget GG, ABX, or any one stock - here's the performance of the gold stock index (which includes 37 of the largest gold companies in the world) to the actual price of gold over the last 10 years.

I hope we can rest this case.

Now, whether mining companies' stock continues to rise or not, its not so relevant if you are investing in gold as a hedge against inflation. To go to one extreme: if all gold reserves were found, gold mining companies are then irrelevant. They may go all under. It doesn't mean the precious metal won't retain value or even increase. And they have. Even if you were to maintain the stocks have stagnated, in the last 3-4 years the price of gold has gone from ~$900 to ~1600.

Actually the same can be argued for the stock market - both the S&P and Dow Jones indexes have outperformed gold over the last 100 years. Turns out the stock market retains value of the dollar better than gold can. And if anyone thought that the USD was going to collapse they would not put their savings in the stock market.

Last edited:

What a weak way to reason!

It's like someone showing all the software companies in the past 30 years that have failed and arguing that all software companies will eventually fail because they produce nothing tangible.

Of course when it comes to Fiat money prudent management by the central bank is paramount - all the banks that mismanage the money supply and general public's trust eventually get punished for it. Fortunately, for the US, mismanagement hasn't been a big issue yet and confidence is by large still very much existent.

It's like someone showing all the software companies in the past 30 years that have failed and arguing that all software companies will eventually fail because they produce nothing tangible.

Of course when it comes to Fiat money prudent management by the central bank is paramount - all the banks that mismanage the money supply and general public's trust eventually get punished for it. Fortunately, for the US, mismanagement hasn't been a big issue yet and confidence is by large still very much existent.

And of course it requires prudent management; that's the whole point: it requires someone doing not only the right thing by all, morally, and doing the right thing in general. One of the objectives of the Federal reserve is to have stable prices. As you may recall, in the preceding 100 years the dollar lost 95-97% of its value. You have to undertand this in context: the dollar/gold stayed steady for basically 2 centuries prior to the Fed. If one wants to argue that inflating the money supply is desirable, then you can go along with Friedman's proposal that there be a formula for a small adjustment year on year where people can predict what is happening. The current Federal reserve is far from such transparency. It's taken a whole bi-partisan movement to even get to vote on auditing the Fed. They found out just the other year that the Fed was giving billions to overseas companies - such a thing is just a snippet of the abuse that can be had.

Ron Paul sounded like an angry old man shouting readings from a script whereas Krugman was trying to have a debate - and the fact that nor Ron Paul nor you (and probably most other Ron Paulists) for that matter don't know about the Repo or how Repo was exactly just like a form of parallel currency does not surprise me. You people just like to read from scripts with limited knowledge of how financial worlds function these days.

I mean, looking at that interview again...it is just embarrassing how a supposed scholar thinks/thought the government "always" set economic policy with the Fed. The moron forgot that pre 1914 there was no Fed, then tried covering his tracks. Then he talks about a "legend" that the Fed cause the depression. He's basically trivialising what most economists generally have a consensus on. And then what does the genius do? He quotes Friedman who was responsible for making famous that "legend", which won him a Nobel Prize haha.

Last edited:

If earnings go up. But savings will be hindered.

You don't buy TIPS or bonds when you're convinced the system is trying to prop itself up (i.e. the Fed buying bonds at an unprecedented rate to keep interest rates low). When that is your concern, you buy gold to hedge against the system. I am trying understand what your point is now. Whether you think they should or not is not my concern; I am explaining why they would do what they say they're doing.

You don't buy TIPS or bonds when you're convinced the system is trying to prop itself up (i.e. the Fed buying bonds at an unprecedented rate to keep interest rates low). When that is your concern, you buy gold to hedge against the system. I am trying understand what your point is now. Whether you think they should or not is not my concern; I am explaining why they would do what they say they're doing.

As a point of clarification (macro 101) - Long-term expectations for inflation are all about people's confidence in the system and what they truly believe the fed will do in the future. The Fed can only hope to set expectations through its communications (which should be considered credible). Therefore, the only way the government can "control" or "prop" expectations for inflation is through being credible.

But you used 5 year performances to help your argument whereas when you use 10 it means you have no argument. As I showed, the GG performance over the past decade showed its stock price +1000 and comfortably outdoing gold itself.

The correct approach is to look at a basket of stocks over time, which I tried to capture through GG, ABX, and AUY - the correct approach is to look at the index.

Now since you can't rely on that you go for the whole Gold index...which proves nothing. Lots of companies go at a loss because a) they're not running their company well, regardless of how much gold there is being found or b) even if there is a boom, it doesn't mean everyone is going to make money. The above graph can be used to show that because of the interest in gold there are too many players, and naturally some will drop off after losses.

If you can show me an example of an index (of any sector) that was showing a decline while that sector was booming - I'll stand corrected. I'm waiting.

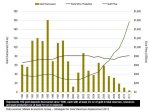

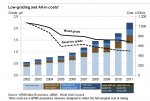

While you look for the above - as I said these two charts summarize while gold stocks have been underperforming gold

The stock market isn't really about retaining value as a hedge, it is about investing for more money. As someone who is in finance, you should know there are different types of investments with different kinds of risks. Gold has basically no risk and has had all upside. Because of its low-risk nature it is not going to yield as much gains, but that's fair enough for those people who want to invest in such a commodity. Moreover, 'the stock market' is a vague aim. You might as well say, "investment in companies shows a great return"...which is the whole game behind the stock market...who to invest with. If you can predict that with such constancy you would be on your own island drinking pina coladas.

As for the stock-market, I didn't say you had to be some genius hedge fund stock picker- I said all you had to do was dump your money in the S&P500 or the dow jones index and you would have outperformed gold.

Nonsense, when the overall conditions and management of those countries have a common denominator there is a reason why they're used as examples.

And of course it requires prudent management; that's the whole point: it requires someone doing not only the right thing by all, morally, and doing the right thing in general. One of the objectives of the Federal reserve is to have stable prices. As you may recall, in the preceding 100 years the dollar lost 95-97% of its value. You have to undertand this in context: the dollar/gold stayed steady for basically 2 centuries prior to the Fed. If one wants to argue that inflating the money supply is desirable, then you can go along with Friedman's proposal that there be a formula for a small adjustment year on year where people can predict what is happening. The current Federal reserve is far from such transparency. It's taken a whole bi-partisan movement to even get to vote on auditing the Fed. They found out just the other year that the Fed was giving billions to overseas companies - such a thing is just a snippet of the abuse that can be had.

And of course it requires prudent management; that's the whole point: it requires someone doing not only the right thing by all, morally, and doing the right thing in general. One of the objectives of the Federal reserve is to have stable prices. As you may recall, in the preceding 100 years the dollar lost 95-97% of its value. You have to undertand this in context: the dollar/gold stayed steady for basically 2 centuries prior to the Fed. If one wants to argue that inflating the money supply is desirable, then you can go along with Friedman's proposal that there be a formula for a small adjustment year on year where people can predict what is happening. The current Federal reserve is far from such transparency. It's taken a whole bi-partisan movement to even get to vote on auditing the Fed. They found out just the other year that the Fed was giving billions to overseas companies - such a thing is just a snippet of the abuse that can be had.

He had to talk over Krugman (who frankly, doesn't shut up), but the cranky old man image...I don't see it. Krugman isn't having a debate, he is propping up the same Keynesian crap he has been and promoting the same inflationary policies. That the moron didn't know simple laws is beyond the pale. Krugman then mentioned a barter system instead. He doesn't understand Paul's reasoning behind currency competition. If the dollar was good, was desirable, then it should not fear competition. There is a reason why such a monopoly exists. The quicker you connect the dots the better.

One debater is a Nobel prize winner in economics the other is a physician. There was no debate.

And I'm sure Krugman who won his Nobel prize on international trade knows less about currency than Ron Paul.

Savings will not be hindered if you're investing in a vehicle that is protected against inflation. I'm not sure what part of this is so hard to digest. And I'm not really sure if the 2nd part of your statement makes any sense - through TIPS the government promises to compensate you for whatever inflation you face 1yr, 2yrs, 3yrs, ..., 10yrs from now. They can do whatever they heck they want with bond prices now but 10yrs from now if there is inflation you'll be compensated.

As a point of clarification (macro 101) - Long-term expectations for inflation are all about people's confidence in the system and what they truly believe the fed will do in the future. The Fed can only hope to set expectations through its communications (which should be considered credible). Therefore, the only way the government can "control" or "prop" expectations for inflation is through being credible.

As a point of clarification (macro 101) - Long-term expectations for inflation are all about people's confidence in the system and what they truly believe the fed will do in the future. The Fed can only hope to set expectations through its communications (which should be considered credible). Therefore, the only way the government can "control" or "prop" expectations for inflation is through being credible.

If you use a long-enough price chart on any large-cap stock you're guaranteed to see a sharp rise in value. It's called survivorship bias.

The correct approach is to look at a basket of stocks over time, which I tried to capture through GG, ABX, and AUY - the correct approach is to look at the index.

I honestly don't understand why you insist on having opinions on matters you know little about. An index is supposed to follow the OVERALL performance of a given sector or group of stocks and hence eliminate the impact of the outliers over time. Therefore, the index is updated regularly so stocks that drop in value or go bust are replaced with new ones, so if anything its artificially propped up as losers are eliminated.

If you can show me an example of an index (of any sector) that was showing a decline while that sector was booming - I'll stand corrected. I'm waiting.

The correct approach is to look at a basket of stocks over time, which I tried to capture through GG, ABX, and AUY - the correct approach is to look at the index.

I honestly don't understand why you insist on having opinions on matters you know little about. An index is supposed to follow the OVERALL performance of a given sector or group of stocks and hence eliminate the impact of the outliers over time. Therefore, the index is updated regularly so stocks that drop in value or go bust are replaced with new ones, so if anything its artificially propped up as losers are eliminated.

If you can show me an example of an index (of any sector) that was showing a decline while that sector was booming - I'll stand corrected. I'm waiting.

You ignored, or didn't see the other part of my post I edited later:

Now, whether mining companies' stock continues to rise or not, its not so relevant if you are investing in gold as a hedge against inflation. To go to one extreme: if all gold reserves were found, gold mining companies are then irrelevant. They may go all under. It doesn't mean the precious metal won't retain value or even increase. And they have. Even if you were to maintain the stocks have stagnated, in the last 3-4 years the price of gold has gone from ~$900 to ~1600.

You've essentially shifted the debate as to gold being a viable hedge; to how gold producers are doing. In such an industry that correlation is not definitive. As I said: there could be no reserves and no gold mining companies at one point...at that point the value of gold will be even higher. Your own graph shows this phenomena. Look at the first graph; as gold discoveries dwindle the value of gold goes up.

Again... you talk about concepts you know nothing about. Gold has no risk? Do you understand the definition of risk in finance? I'll save you time you'll spend googling it - It is the standard deviation of fluctuations in value of an asset over a period of time. Tell Gold has no risk to the person bought it in 1980 and had to sell for less than half that in early 2000s. Ironically - the only assets in finance which are deemed to be risk free are the US treasury bills.

As for the stock-market, I didn't say you had to be some genius hedge fund stock picker- I said all you had to do was dump your money in the S&P500 or the dow jones index and you would have outperformed gold.

Last edited:

Again it's not about having CONSTANT prices...it's about having STABLE prices..so if the fed comes out and says they're targeting 2% inflation and inflation turns out to be 2% that's considered stable.

I'm glad you went back and edited your post and took out the part about Krugman not having brought up the Repo example - Ron Paul had no idea what Krugman was referring to because he is out of his league. You didn't either that's why you had to go back and listen to it again.

One debater is a Nobel prize winner in economics the other is a physician. There was no debate.

And I'm sure Krugman who won his Nobel prize on international trade knows less about currency than Ron Paul.

One debater is a Nobel prize winner in economics the other is a physician. There was no debate.

And I'm sure Krugman who won his Nobel prize on international trade knows less about currency than Ron Paul.

Do you read Paul Krugman's blog?

Just when he writes nasty individual comments that people forward.

Oh, well he wrote a series of posts saying he thought the World War II spending evidence was not good, for a variety of reasons, but I guess...

He said elsewhere that it was good and that it was what got us out of the depression. He just says whatever is convenient for his political argument. He doesn't behave like an economist. And the guy has never done any work in Keynesian macroeconomics, which I actually did. He has never even done any work on that. His work is in trade stuff. He did excellent work, but it has nothing to do with what he's writing about.

Just when he writes nasty individual comments that people forward.

Oh, well he wrote a series of posts saying he thought the World War II spending evidence was not good, for a variety of reasons, but I guess...

He said elsewhere that it was good and that it was what got us out of the depression. He just says whatever is convenient for his political argument. He doesn't behave like an economist. And the guy has never done any work in Keynesian macroeconomics, which I actually did. He has never even done any work on that. His work is in trade stuff. He did excellent work, but it has nothing to do with what he's writing about.

Last edited:

I also found this article re Gold vs SP500. Pretty enlightening and opposes what you said re performance.

Gold Vs. S&P 500 - Which Is A Better Investment?

Banks and stock brokerage houses like Citigroup (C), Morgan Stanley (MS), Goldman Sachs (GS) and JP Morgan Chase (JPM) are ready to join together, and chant the mantra of the Cult of Equities. They've got a lot of supporters in the field of economics and finance. The mantra is something like this, repeated over and over again:

Stocks are the best investment over time.

Most of these same folks also advise that "aggressive" investors, willing to take "risk" and buy "growth" stocks, which pay little or no dividends, earn the most over long periods of time. The same people also tend to advise that gold (GLD) (IAU) (PHYS) is a bad investment because it pays no interest and is "speculative."

First, gold DOES pay interest to those willing to take the risk of lending it out. There is an active market for lending gold. But, that is a story for another day. The story for today is putting the Cult of Equities to the test. Are stocks really the best investment over long periods of time?

A number of factors are involved. We should remember that past performance is no guarantee of future performance. But, for the sake of curiosity, we can potentially look at the performance of several different stock indexes like the DOW Industrial Average (DIA), the S&P 500 (SPY) and the NASDAQ (QQQ). Once we've done that, we can compare them with gold.

My first inclination was to look at the most recent decade. But, stock performance since year 2000 has been dismal. Equities certainly have NOT been a good investment since then. So, to be fair, I decided to look at a more substantial period of time. Furthermore, of the commonly known and used indexes, I decided to use the S&P 500. It is much broader than both the DOW and NASDAQ 100, and it has been around for 55 years.

If we take a quick glance at the performance of equities over the last 55 years, they look great. But, we must look deeper. Remember, the Fed and other central banks have a perpetual inflation policy. They have carefully nurtured ever-depreciating fiat currencies. Neither the U.S. dollar or any other currency has had a fixed value since 1933. A 1957 dollar is worth much more than a dollar in 2012. Comparing the simple value of the S&P 500 in 1957 to the value now, therefore, is like comparing apples and oranges.

In comparison to easily printable dollars, gold is a tangible item of limited quantity. Accordingly a "semi-fixed" value can be assigned to it, at least for purposes of doing our analysis. As soon as we move away from the depreciated fiat currencies, and begin to measure performance against the inflation resistant gold "money," stock performance declines markedly.

Standard and Poor's began publishing the S&P 500 index on March 4, 1957, at an approximate value of 45. At the same time, gold was selling on the free market, in Zurich, Switzerland, for about $35 per troy ounce. That was approximately the same price at which gold was traded between national treasuries. Since then, gold has risen to about $1,770 per troy ounce. That means that, since 1957, the U.S. dollar has retained slightly less than 2% of its value measured in gold ounces.

To avoid a loss of gold buying power, S&P 500 index fund investors need the index to rise to a bit less than 2,250. Unfortunately, it has never been that high. Yesterday, for example, the S&P 500 closed at 1,433, not far from its all-time highs, but less than 2/3rds of the way to 2,250. Over the last 55 years, in other words, S&P 500 investors have lost about 1/3rd of their capital in terms of gold.

It is true that we haven't added dividend income. We also haven't deducted taxes, commissions and fees, or the interest that can, theoretically, be gained from loaning out gold. Without that dividend yield, the S&P 500 investors would have lost big time. But stock investors do collect dividends. They also pay taxes. The current 15% dividend tax hasn't been around very long. They are a part of the Bush era tax cuts that may not survive the "fiscal" cliff coming on January 1, 2013.

During the 1960s and 70s, top tax rates ranged as high as 90%. As increasingly insolvent governments become increasingly desperate for cash, they may move closer to that range in the future. In addition to dividend taxation, changes in the stock index have forced S&P 500 investors to recognize capital gains. That is because such investors cannot simply keep stocks for 55 years. The index is always changing. Stocks are moved in and moved out.

Investors must buy and sell stocks almost every year just to keep up with changes in the referenced index and weightings. Whenever this happens, they must recognize capital gain. They must also pay commissions and fees. While the cost of trading is now cheap, in the old days, brokerage commissions could range as high as 3% for a round trip buy and sell.

To make matters worse, because of central bank inflation policy, many of the capital gains upon which taxes must be paid, actually result from nominal, rather than real appreciation. That means stock investors are regularly paying taxes on inflation, rather than an increase in the real value of their holdings. In contrast, gold investors can simply keep gold in a vault forever. When they die, the gold becomes the property of the heirs, and it is assigned a stepped up tax basis. Their "cost" is whatever the gold is worth at the time of death.

Right now, stocks sit on a precipice. They have soared since 2009, primarily because of the massive monetary debasement since then. But, a huge generational bubble is about to burst. No amount of money printing will change this fundamental. The baby boom generation is retiring. Those retirees will need to liquidate investments. We have seen some of that. Hundreds of billions have been pulled from stock funds over the last year. Even so, about 99% of all retiree assets (other than the houses they live in) is invested in financial assets like stocks and bonds. Retirees don't generate earned income, and cannot substantially increase stock and bond holdings. In contrast, 401K retirement plans contain almost no gold at all so the liquidation is unlikely to affect gold prices.

How an S&P 500 investor performed since 1957 would largely be determined by his tax bracket in the intervening years. But, looked at broadly, stock investors stand about even with gold investors, so long as we add back the dividend income, deduct the commissions and fees and discount the fact that taxes had to be paid on nominal but fake capital gains. But, in order to attract investment, given that the chance of loss is great whenever money (in this case, gold) is put at risk, stocks need to have performed much better than gold in order to justify investing in them. That simply has not been the case, and the trend of the last decade implies that things will get much worse for equities.

The "wonders" of stock investing don't hold up under the microscope. Although fiat money can be manufactured out of thin air, value cannot be. Society's capacity to produce depends on people. The amount of gold, taken from the ground, has approximately kept pace with the population. So, it does makes sense that gold and stocks would perform approximately equal over long periods of time, which has been the case. Going forward, however, western society's age demographics are highly unfavorable to further stock price appreciation except from monetary inflation.

So, what is the better investment? Gold or the S&P 500 stocks? With respect to the past, that depends partly on your tax bracket, and partly on what you want the money for. If you intend to pass a legacy on to your children, gold appears to be the better investment. If you want to consume part of your capital during your lifetime, however, historically, the S&P 500 would have been a slightly better bet. Remember, though, past performance is no guaranty of future performance. Going forward, S&P 500 investors are facing a western world in severe demographic decline and unsustainable government and private debt. Gold is likely to perform much better than a broad stock index during the next decade, at least.

Banks and stock brokerage houses like Citigroup (C), Morgan Stanley (MS), Goldman Sachs (GS) and JP Morgan Chase (JPM) are ready to join together, and chant the mantra of the Cult of Equities. They've got a lot of supporters in the field of economics and finance. The mantra is something like this, repeated over and over again:

Stocks are the best investment over time.

Most of these same folks also advise that "aggressive" investors, willing to take "risk" and buy "growth" stocks, which pay little or no dividends, earn the most over long periods of time. The same people also tend to advise that gold (GLD) (IAU) (PHYS) is a bad investment because it pays no interest and is "speculative."

First, gold DOES pay interest to those willing to take the risk of lending it out. There is an active market for lending gold. But, that is a story for another day. The story for today is putting the Cult of Equities to the test. Are stocks really the best investment over long periods of time?

A number of factors are involved. We should remember that past performance is no guarantee of future performance. But, for the sake of curiosity, we can potentially look at the performance of several different stock indexes like the DOW Industrial Average (DIA), the S&P 500 (SPY) and the NASDAQ (QQQ). Once we've done that, we can compare them with gold.

My first inclination was to look at the most recent decade. But, stock performance since year 2000 has been dismal. Equities certainly have NOT been a good investment since then. So, to be fair, I decided to look at a more substantial period of time. Furthermore, of the commonly known and used indexes, I decided to use the S&P 500. It is much broader than both the DOW and NASDAQ 100, and it has been around for 55 years.

If we take a quick glance at the performance of equities over the last 55 years, they look great. But, we must look deeper. Remember, the Fed and other central banks have a perpetual inflation policy. They have carefully nurtured ever-depreciating fiat currencies. Neither the U.S. dollar or any other currency has had a fixed value since 1933. A 1957 dollar is worth much more than a dollar in 2012. Comparing the simple value of the S&P 500 in 1957 to the value now, therefore, is like comparing apples and oranges.

In comparison to easily printable dollars, gold is a tangible item of limited quantity. Accordingly a "semi-fixed" value can be assigned to it, at least for purposes of doing our analysis. As soon as we move away from the depreciated fiat currencies, and begin to measure performance against the inflation resistant gold "money," stock performance declines markedly.

Standard and Poor's began publishing the S&P 500 index on March 4, 1957, at an approximate value of 45. At the same time, gold was selling on the free market, in Zurich, Switzerland, for about $35 per troy ounce. That was approximately the same price at which gold was traded between national treasuries. Since then, gold has risen to about $1,770 per troy ounce. That means that, since 1957, the U.S. dollar has retained slightly less than 2% of its value measured in gold ounces.

To avoid a loss of gold buying power, S&P 500 index fund investors need the index to rise to a bit less than 2,250. Unfortunately, it has never been that high. Yesterday, for example, the S&P 500 closed at 1,433, not far from its all-time highs, but less than 2/3rds of the way to 2,250. Over the last 55 years, in other words, S&P 500 investors have lost about 1/3rd of their capital in terms of gold.

It is true that we haven't added dividend income. We also haven't deducted taxes, commissions and fees, or the interest that can, theoretically, be gained from loaning out gold. Without that dividend yield, the S&P 500 investors would have lost big time. But stock investors do collect dividends. They also pay taxes. The current 15% dividend tax hasn't been around very long. They are a part of the Bush era tax cuts that may not survive the "fiscal" cliff coming on January 1, 2013.

During the 1960s and 70s, top tax rates ranged as high as 90%. As increasingly insolvent governments become increasingly desperate for cash, they may move closer to that range in the future. In addition to dividend taxation, changes in the stock index have forced S&P 500 investors to recognize capital gains. That is because such investors cannot simply keep stocks for 55 years. The index is always changing. Stocks are moved in and moved out.

Investors must buy and sell stocks almost every year just to keep up with changes in the referenced index and weightings. Whenever this happens, they must recognize capital gain. They must also pay commissions and fees. While the cost of trading is now cheap, in the old days, brokerage commissions could range as high as 3% for a round trip buy and sell.

To make matters worse, because of central bank inflation policy, many of the capital gains upon which taxes must be paid, actually result from nominal, rather than real appreciation. That means stock investors are regularly paying taxes on inflation, rather than an increase in the real value of their holdings. In contrast, gold investors can simply keep gold in a vault forever. When they die, the gold becomes the property of the heirs, and it is assigned a stepped up tax basis. Their "cost" is whatever the gold is worth at the time of death.

Right now, stocks sit on a precipice. They have soared since 2009, primarily because of the massive monetary debasement since then. But, a huge generational bubble is about to burst. No amount of money printing will change this fundamental. The baby boom generation is retiring. Those retirees will need to liquidate investments. We have seen some of that. Hundreds of billions have been pulled from stock funds over the last year. Even so, about 99% of all retiree assets (other than the houses they live in) is invested in financial assets like stocks and bonds. Retirees don't generate earned income, and cannot substantially increase stock and bond holdings. In contrast, 401K retirement plans contain almost no gold at all so the liquidation is unlikely to affect gold prices.

How an S&P 500 investor performed since 1957 would largely be determined by his tax bracket in the intervening years. But, looked at broadly, stock investors stand about even with gold investors, so long as we add back the dividend income, deduct the commissions and fees and discount the fact that taxes had to be paid on nominal but fake capital gains. But, in order to attract investment, given that the chance of loss is great whenever money (in this case, gold) is put at risk, stocks need to have performed much better than gold in order to justify investing in them. That simply has not been the case, and the trend of the last decade implies that things will get much worse for equities.

The "wonders" of stock investing don't hold up under the microscope. Although fiat money can be manufactured out of thin air, value cannot be. Society's capacity to produce depends on people. The amount of gold, taken from the ground, has approximately kept pace with the population. So, it does makes sense that gold and stocks would perform approximately equal over long periods of time, which has been the case. Going forward, however, western society's age demographics are highly unfavorable to further stock price appreciation except from monetary inflation.

So, what is the better investment? Gold or the S&P 500 stocks? With respect to the past, that depends partly on your tax bracket, and partly on what you want the money for. If you intend to pass a legacy on to your children, gold appears to be the better investment. If you want to consume part of your capital during your lifetime, however, historically, the S&P 500 would have been a slightly better bet. Remember, though, past performance is no guaranty of future performance. Going forward, S&P 500 investors are facing a western world in severe demographic decline and unsustainable government and private debt. Gold is likely to perform much better than a broad stock index during the next decade, at least.

Gold is a long-term hedge, which is why your 2-3 year analysis of it is not only irrelevant it is academically dishonest. As the Schiff video above you mentions.

Did you read the %+- for SP500 vs Paul's stocks? Try again.

It means that what he did was far better than what the top 500 companies, according to SP, did in the stock market.

Gold is a what?

Tell us more....about the latter...go on...

Tell us more....about the latter...go on...

[video=youtube;rUc-u8fyNyo]http://www.youtube.com/watch?v=rUc-u8fyNyo[/video]

Last edited: